|

| ||||||||||||||||||||

Please note that JDLand is no longer being updated.

Oops.

- Full Neighborhood Development MapThere's a lot more than just the projects listed here. See the complete map of completed, underway, and proposed projects all across the neighborhood.

- What's New This YearA quick look at what's arrived or been announced since the end of the 2018 baseball season.

- Food Options, Now and Coming SoonThere's now plenty of food options in the neighborhood. Click to see what's here, and what's coming.

- Anacostia RiverwalkA bridge between Teague and Yards Parks is part of the planned 20-mile Anacostia Riverwalk multi-use trail along the east and west banks of the Anacostia River.

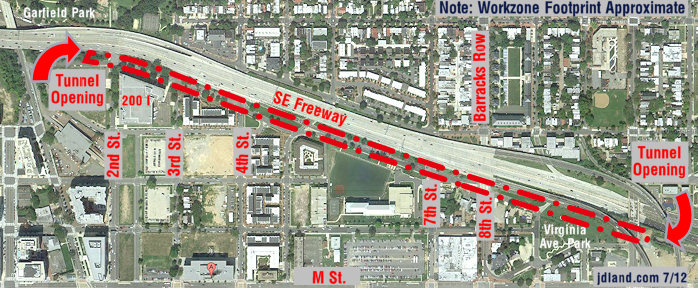

- Virginia Ave. Tunnel ExpansionConstruction underway in 2015 to expand the 106-year-old tunnel to allow for a second track and double-height cars. Expected completion 2018.

- Rail and Bus Times

Get real time data for the Navy Yard subway, Circulator, Bikeshare, and bus lines, plus additional transit information. - Rail and Bus Times

Get real time data for the Navy Yard subway, Circulator, Bikeshare, and bus lines, plus additional transit information. - Canal ParkThree-block park on the site of the old Washington Canal. Construction begun in spring 2011, opened Nov. 16, 2012.

- Nationals Park21-acre site, 41,000-seat ballpark, construction begun May 2006, Opening Day March 30, 2008.

- Washington Navy YardHeadquarters of the Naval District Washington, established in 1799.

- Yards Park5.5-acre park on the banks of the Anacostia. First phase completed September 2010.

- Van Ness Elementary SchoolDC Public School, closed in 2006, but reopening in stages beginning in 2015.

- Agora/Whole Foods336-unit apartment building at 800 New Jersey Ave., SE. Construction begun June 2014, move-ins underway early 2018. Whole Foods expected to open in late 2018.

- New Douglass BridgeConstruction underway in early 2018 on the replacement for the current South Capitol Street Bridge. Completion expected in 2021.

- 1221 Van290-unit residential building with 26,000 sf retail. Underway late 2015, completed early 2018.

- NAB HQ/AvidianNew headquarters for National Association of Broadcasters, along with a 163-unit condo building. Construction underway early 2017.

- Yards/Parcel O Residential ProjectsThe Bower, a 138-unit condo building by PN Hoffman, and The Guild, a 190-unit rental building by Forest City on the southeast corner of 4th and Tingey. Underway fall 2016, delivery 2018.

- New DC Water HQA wrap-around six-story addition to the existing O Street Pumping Station. Construction underway in 2016, with completion in 2018.

- The Harlow/Square 769N AptsMixed-income rental building with 176 units, including 36 public housing units. Underway early 2017, delivery 2019.

- West Half Residential420-unit project with 65,000 sf retail. Construction underway spring 2017.

- Novel South Capitol/2 I St.530ish-unit apartment building in two phases, on old McDonald's site. Construction underway early 2017, completed summer 2019.

- 1250 Half/Envy310 rental units at 1250, 123 condos at Envy, 60,000 square feet of retail. Underway spring 2017.

- Parc Riverside Phase II314ish-unit residential building at 1010 Half St., SE, by Toll Bros. Construction underway summer 2017.

- 99 M StreetA 224,000-square-foot office building by Skanska for the corner of 1st and M. Underway fall 2015, substantially complete summer 2018. Circa and an unnamed sibling restaurant announced tenants.

- The Garrett375-unit rental building at 2nd and I with 13,000 sq ft retail. Construction underway late fall 2017.

- Yards/The Estate Apts. and Thompson Hotel270-unit rental building and 227-room Thompson Hotel, with 20,000 sq ft retail total. Construction underway fall 2017.

- Meridian on First275-unit residential building, by Paradigm. Construction underway early 2018.

- The Maren/71 Potomac264-unit residential building with 12,500 sq ft retail, underway spring 2018. Phase 2 of RiverFront on the Anacostia development.

- DC Crossing/Square 696Block bought in 2016 by Tishman Speyer, with plans for 800 apartment units and 44,000 square feet of retail in two phases. Digging underway April 2018.

- One Hill South Phase 2300ish-unit unnamed sibling building at South Capitol and I. Work underway summer 2018.

- New DDOT HQ/250 MNew headquarters for the District Department of Transportation. Underway early 2019.

- 37 L Street Condos11-story, 74-unit condo building west of Half St. Underway early 2019.

- CSX East Residential/Hotel225ish-unit AC Marriott and two residential buildings planned. Digging underway late summer 2019.

- 1000 South Capitol Residential224-unit apartment building by Lerner. Underway fall 2019.

- Capper Seniors 2.0Reconstruction of the 160-unit building for low-income seniors that was destroyed by fire in 2018.

- Chemonics HQNew 285,000-sq-ft office building with 14,000 sq ft of retail. Expected delivery 2021.

Sorry, there's a problem at JDLand.com right now. (Well, even more so than usual. I know that this is getting old, believe me.)

This is probably just an issue with the code on this particular page, so you

should be able to browse the rest of the site.

If not, and if you're desperate for content, you can read the latest blog posts here,

plus there's the JDLand Twitter and/or Facebook accounts for additional time-wasting.

Try (or Retry) the JDLand Home Page